If you don’t use a credit card responsibly, it’s extremely easy to fall into debt up to your eyeballs. Credit cards are powerful tools that can help or hurt your money management skills. Discover how to manage credit cards wisely so you can fully enjoy their benefits. These tips apply to first time credit card owners, as well as seasoned adults.

3 Top Benefits of Responsible Credit Card Usage

Keep in mind that these benefits only remain benefits if you use a credit card in a responsible, financially healthy way.

Benefit #1: You can make a larger purchase and pay it back over time, rather than emptying your savings account all at once.

Benefit #2: You could earn cash back and/or rewards for making everyday purchases you would’ve made with your debit card anyway.

Benefit #3: You can build a positive credit history and increase your credit score over time with responsible usage.

7 Tips for How to Manage Credit Cards Wisely

Follow these tips to fully benefit from the three top advantages listed above.

-

1. Find a card with attractive rates and rewards.

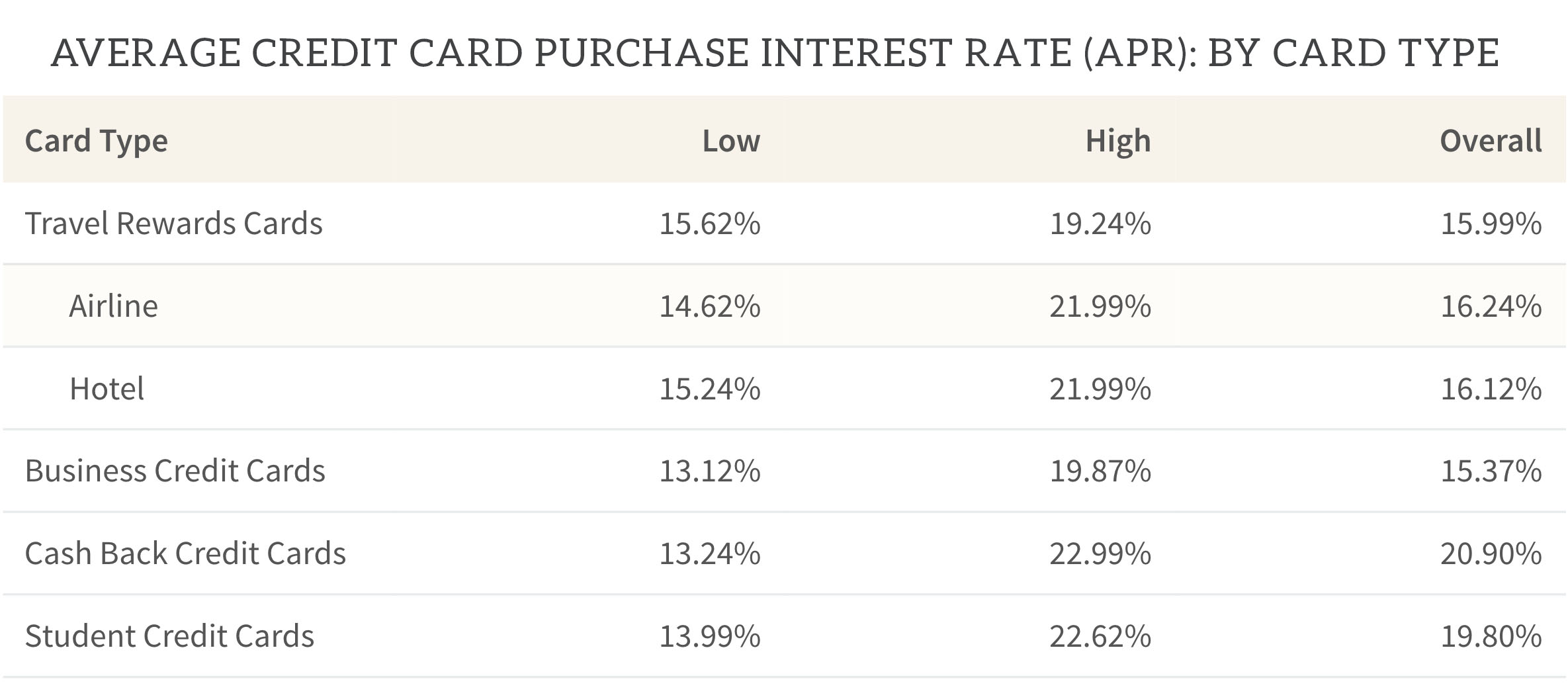

Credit card interest rates are notoriously high. If you leave a revolving balance on your credit card, the interest rate can exponentially increase how much you owe. Take a look at Value Penguin’s 2017 study:

When you’re searching for a credit card, look for a card with the lowest interest rate possible. Also take into account if a card has annual fees, and what rewards system is in place that would make that annual fee worth it.

Keep in mind that local credit unions often offer much more attractive interest rates on credit cards for their members than a traditional bank. At White Rose, our VISA Classic Credit Card starts at only 10.49%APR.

-

2. Attempt to pay your balance in full every month.

The best way to avoid your balances growing due to interest is to pay off your debt in full every single month. If you pay off the entire balance amount, there will be no interest added to your bill.

-

3. If you can’t pay in full, at least never skip a payment.

Sometimes it’s not realistic for you to pay off your entire balance in one payment. However, even if you can’t follow that advice – at the very least make the minimum payment required for the month. Making the minimum payment, or the largest payment amount that you can afford, is a much better option than simply skipping that month’s payment.

Skipping a payment will result in not only an additional late fee, but the missing payment will be reported to the major credit bureaus. That missing payment can impact your credit score, making it more difficult to get approved for loans in the future at attractive interest rates.

-

4. Keep your credit utilization ratio under 30%.

The best hack to using a credit card to increase your credit score is to stay under the recommended credit utilization ratio. The credit bureaus use this ratio to determine your credit score. The credit utilization ratio is the amount of debt compared to your total credit line available.

For example, if you have one credit card with a $1,000 balance and you currently owe $600 on that card, your ratio is 60%. You want to keep this number as low as possible – preferably under 30%. Try to never use more than 30% of the total credit line on any credit card you have open.

5. Prioritize needs over wants when spending.

People get into trouble when they use a credit card like a debit card or cash. They can lose track of the fact that they are spending more than they can afford to pay back at the end of the month. The easiest way to stay on top of a credit card bill and budget appropriately is to use the credit card for needs rather than wants.

If you use the credit card for purchases you know you’d have to make anyway, like groceries and gas, then you can accurately budget for the bill at the end of every month. If you’re using a cash back or rewards credit card, you will gain rewards on purchases that you would’ve made regardless.

Use this worksheet to teach teenagers and young adults about wants vs. needs.

-

6. Avoid common credit card fraud schemes.

Credit card users can easily become victims of fraud or identity theft scams. If you open a credit card, part of using it responsibly is to be aware of common scams and how to avoid them.

Follow these basic tips to avoid credit card fraud:

- Don’t use an ATM or gas station pump if you suspect the machine has been tampered with or contains a credit card skimmer.

- Only shop online at websites that are securely encrypted to protect your personal information. Look for a URL that starts with HTTPS://.

- Regularly monitor your account to identify any fraudulent purchases. Make sure to report these suspicious charges to your credit card company and dispute the charge.

- Use a chip rather than the magnetic strip to make a purchase.

- Never share your card number or 3-digit code in a public space, like social media.

-

7. Don’t open too many credit cards in your name.

Once you open your first credit card, you’ll notice that you receive countless credit card offers in the mail. These offers may advertise 0% interest rates for the first couple months, or a special rewards program, but it’s smart to ignore most of these offers. Only open a new credit card if it’s a smart financial decision – not just to win that free iPad they’re offering.

Opening too many credit cards in a short period of time is a red flag to the credit bureaus. Your credit score could decrease if you open too many cards in a short time period. Also, it can become difficult to keep up with payments if you have too many credit cards open. It’s smart to have a back-up credit card in case of emergencies, but beyond that it can get difficult.

If you follow these seven tips, you can fully benefit from having a credit card in your name and know that you’re being a responsible credit card owner.

Discover if you’ve been using your credit card responsibly.

Get a copy of your credit report to see if you’re in a financially healthy place. You’re entitled to one, FREE credit report from each of the three major bureaus every year. Discover how to access the credit report here.