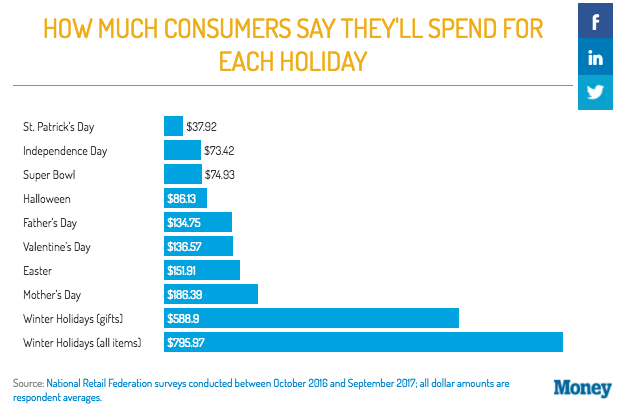

It’s not surprising that the holidays are filled with scams and fraudulent schemes. Consumers spend a ton of money each holiday season – more than four times as much money on the winter holidays than any other holiday. Use these holiday shopping precautions to protect yourself from common holiday scams this year.

Source: Money | Allana Akhtar

Common holiday fraud schemes

With so many Americans spending money during the months of November and December, it’s a prime opportunity to hackers and scammers to gain access to personal information. Here are a few common scams we see pop-up around the holidays.

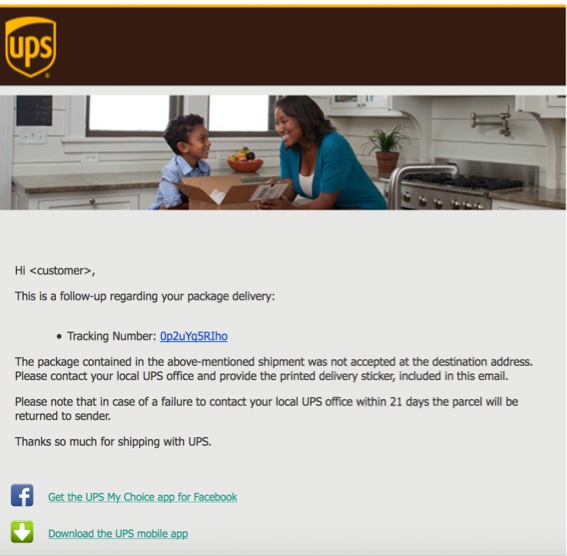

Phishing

This is a technique scammers use to gain access to personal, sensitive information like usernames, credit card numbers, and passwords. They do this by disguising themselves as a trustworthy source in some type of electronic communication, like an email or a website. Hackers place links or attachments in emails and entice you to click on them. The attachment could infect your computer, and links could take you to a malicious website.

During the holidays, it’s common to see hackers send emails that advertise incredible deals, false shipping notifications, or even emails that send visitors to counterfeit websites to shop.

Source: EDTS | Charles Johnson

Take these precautions:

- Don’t open emails from unknown senders.

- Don’t click on links or open attachments in suspicious emails.

- Be on the lookout for websites or emails that contain spelling errors, inspire a sense of urgency to complete a task, or offer something too good to be true.

- Don’t give out any personal information without verifying the request from an additional source. If an email is asking you to enter a password, visit the website separately and call their customer service line to verify the request.

- Only shop on legitimate websites. When checking out on a website, only enter personal information on a url that starts with HTTPS. The ‘s’ shows that the site has paid for additional encryption for that url.

Merchant data breaches

Large retailers are often in the news for large scale data breaches. These breaches occur when a hacker gains access to cardholder data from a particular merchant. If your card was part of a data breach, your financial institution may issue you a new card with a new card number.

Take these precautions:

- Shop with a credit card for extra fraud protection from large issuers like VISA.

- Use only one credit card for your holiday purchases. That way if there is a merchant data breach, only one card would be affected.

- Monitor your accounts on a regular basis to see if any fraud has occurred. Use resources like mobile banking or online banking to keep tabs on your account.

Card skimming

Criminals use these small, hidden devices to capture sensitive card information. They are often placed over card readers at gas stations and ATMs and designed to electronically read your card number. The hackers will also use a small camera or keypad reader to capture your pin number as well.

Source: The Balance | Justin Pritchard

As you can see in this photo, the skimmer is placed over the card entry slot. The color does not match the surrounding plastic, and it shows evidence of damage during placement.

Take these precautions:

- Pick an ATM in a well-lit, secure area – like inside of a bank. Hackers will be less likely to place skimmers where they could be caught in the act.

- Pick the gas station pump closest to entrance with a clear line of sight to the cashier.

- Look for obvious signs of tampering, like parts that look out-of-place, are loose, or mismatched in color or material.

- Use your hand to cover the keypad while entering in your pin number.

- Try to use your EMV chip rather than your magnetic stripe whenever possible.

As long as you follow these basic precautions, your personal information will likely stay safe this holiday season. Remember, if you do think you’ve been a victim of fraud, contact your financial institution immediately!

Get more helpful tips

Subscribe to our blog for more financial advice and precautions. You’ll get regular updates sent straight to your email! Subscribe now.

Oops! We could not locate your form.