Switching financial institutions falls squarely under the life category – ‘things you think will be more difficult and painful than they actually are once you do them.’ Too many people don’t switch banks because they worry about how hard the process will be. The fact is that the easiest way to switch banks is just to do it. Create a strategy, open a new account, and then close the old one. We’ve broken it down into three simple steps so that you can see just how easy it can be!

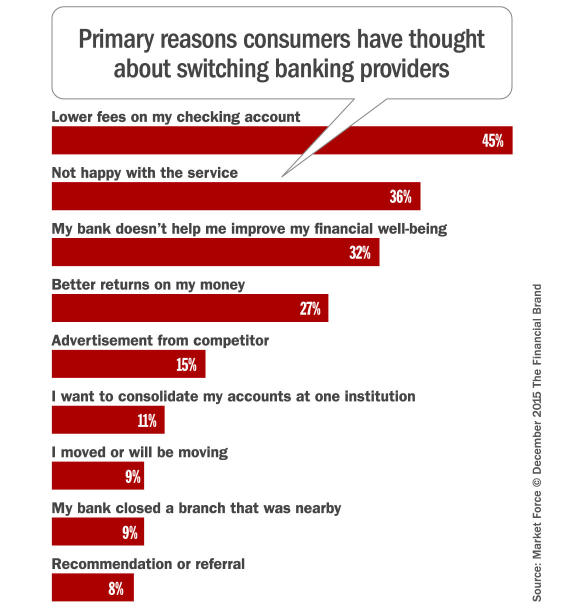

Source: The Financial Brand

Step One: Create Your Strategy

The easiest way to switch banks is to make a plan before touching any of your money. Sit down and think about all of the deposits, withdrawals, transfers, payments, etc., that go through your current financial institution. Make a list of all of the items you’ll need to review and change when switching accounts. This can serve as a checklist so you don’t miss any updates while switching.

Here are some of the common items to add to your personalized checklist/strategy:

- Direct deposits

- Automatic bill payments

- Recurring transfers

- Any linked bank accounts

- Any alerts you have set up for your accounts

- Paper checks

- Safe deposit box

- Your online and/or mobile banking accounts

Tip from the experts:

Go through your bank statements, either paper or in your online banking account, to find any items you may have forgotten about. It’s easy to forget about things like a $1.99 automatic payment set up to Apple or your monthly gym membership.

Step Two: Open Your New Account

Open your new account while you still have ownership of the old one. This will give you time to change all of your direct deposits, payments, and other items on the checklist without missing any bills.

If you’re still undecided about which financial institution you want to switch to – use these articles as a resource.

The Top 5 Advantages of Joining a Credit Union in 2018

Ask These 7 Questions Before Choosing Your Next Savings Account

Once the new account is open, you can start working through the strategy you created in the first step. Switch your employer’s direct deposit to the new account. Once you have cash flow, changed all future payments and transfers to the new account. Then you can finish up the checklist by signing up for the new mobile banking service, and ordering new checks.

Tip from the experts:

Keep enough money in your old account to meet the minimum balance requirements and cover leftover bills that may fall through the cracks. You don’t want to be charged an unnecessary account fee for falling below a certain balance, or pay an overdraft charge because there weren’t enough funds to pay a bill.

Step Three: Empty & Close Your Old Account

Once you have your checklist finished, you can officially close the old account. Empty out any leftover funds and request to close out the account. They can give you the funds in cash or through a bank-certified check. You can then take that cash or check to your new financial institution and deposit it.

Tip from the experts:

Request written confirmation that the account has been closed. Also, make sure that they won’t reopen your account to pay a forgotten bill and charge you an overdraft fee to do so.

Is that it?

Yes – it’s really that simple. As long as you are thorough in creating your strategy, it will not be a long or stressful process. Plus, the financial institution you’re switching to will be incentivized to make it as simple as possible. They will likely have any paperwork or checklists you may need to make the switch happen. Just ask them!

If you have any questions about switching accounts, leave them in the comments below!

Get White Rose’s FREE Switch Kit

At White Rose Credit Union, we offer a FREE downloadable switch kit for anyone interested in becoming a member. The switch kit will break down every single step of the process and provides checklists that you can use. Get the switch kit now!