Now more than ever, it’s essential that our members keep their financial and personal information safe and secure. are committed to keeping you informed so you can best protect yourself from fraud and scams. To learn more about how you can help protect yourself and read more important guidelines, click the information below.

Email Security Tips

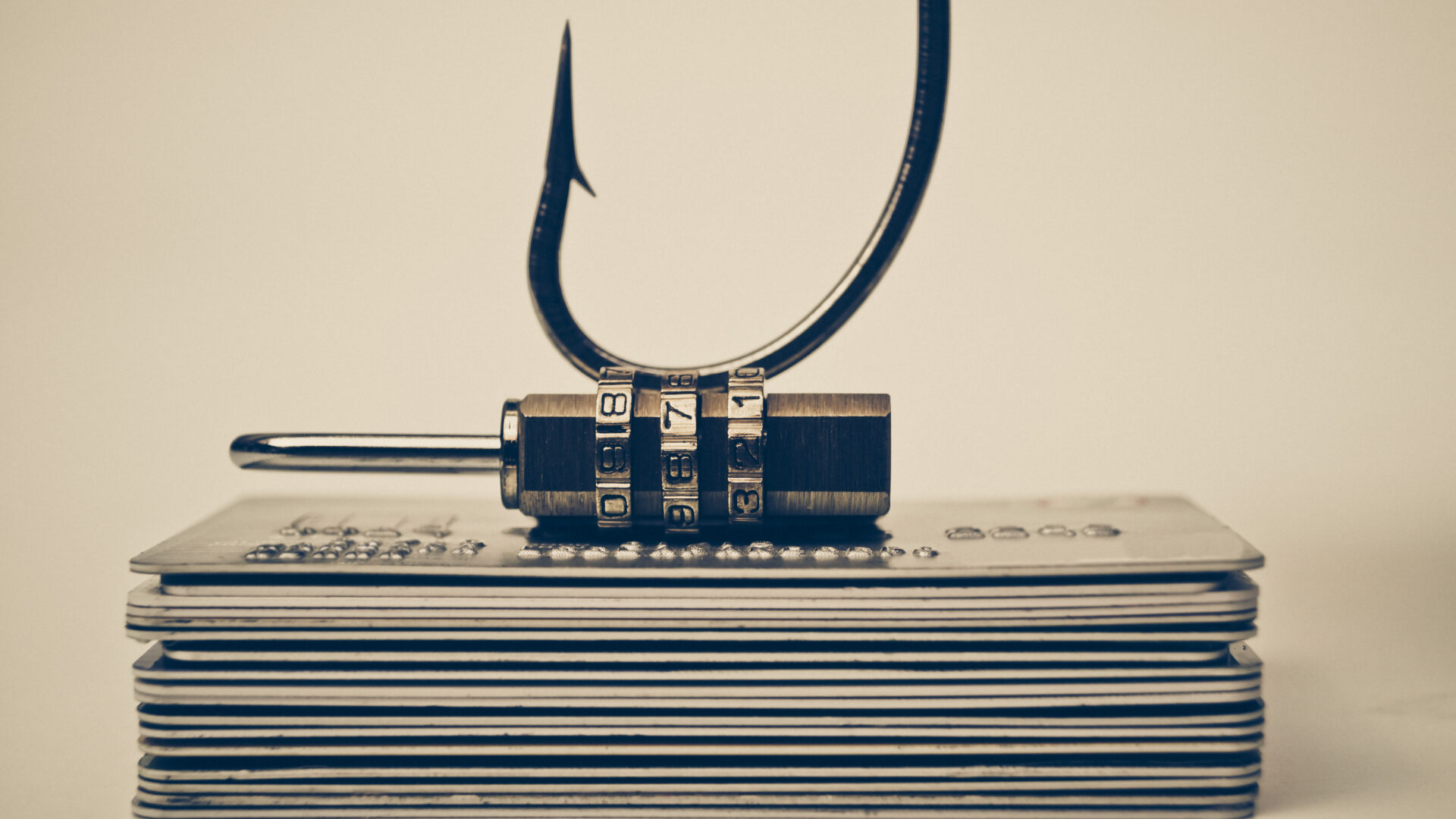

Be alert for fraudulent (sometimes called “phishing”) emails. They may appear to come from a reputable business or a trusted friend but are actually designed to trick you into downloading a virus to your computer or directing you to a website to disclose sensitive or personal information.

Reputable businesses never request personal information (Social Security or credit card numbers, for example) via email.

Never send your personal information via unsecured email. If WRCU needs information beyond your name, address, email address and phone number, we will provide you with a secure email form.

If an email from an unknown – or unsolicited – sender contains an attachment of any kind, do not open it. Delete the email immediately.

Be cautious when clicking on a link in an email that you receive. It may be fraudulent, even though the URL may be identical to the actual company’s website. To check the ownership of the destination page, open a new browser window and manually type in the URL provided in the email. If they do not match, immediately delete the email with the suspicious link.

Online Security Tips

If you suspect a website is not what it claims to be, leave it immediately. Do not follow any of the instructions it presents.

Only do business with companies you know and trust.

Only use your credit card number on Internet sites that have a secure, encrypted system (look for the “HTTPS” in the address line or lock icon).

Provide sensitive personal or financial information only when you have initiated it and only if the page is secure.

Choose passwords or Personal Identification Numbers (PINs) that are difficult for others to guess (NOT your birthday or street address or the last four digits of your Social Security number), and use a different password for each of your Internet accounts. Change these passwords frequently. Use both letters and numbers and a combination of lower and upper-case letters if the passwords are case sensitive.

Password Security

The complexity of your password is an important line of defense against fraud. The more complex your password is, the more difficult it will be for potential identity thieves to gain access to your account. Passwords should be at least eight characters and contain uppercase letters, lowercase letters and numerals. Never use all or portions of your name, social security number, date of birth or phone number. Disregard the “remember my password” option on shopping and banking sites.

Credit and Debit Fraud

Credit and debit fraud involves the unauthorized use of another persons card information to make purchases from their account to access their funds. Card fraud occurs through a variety of channels including online scams, data breaches and card or mail theft. Know the warning signs and how to defend yourself.

Some warning signs that you have been a victim of debit and credit card fraud are unexplained withdrawals from your account, suspicious charges and unfamiliar accounts and inquiries on your credit report.

How To Protect Yourself:

- Monitor your credit card and bank account activity transactions often including pending transactions. The more you check your statements and transaction history, the quicker you will spot suspicious activity.

- Sign up for e-Alerts on our mobile app

- Check your credit report regularly.

- Be cautious when shopping online. Make sure the site is secure by looking for a padlock and https on the address bar.

- Don’t fall victim to a phishing scam. Someone asking you to provide information over the phone? It’s important to know with whom you are sharing your personal information with. Be sure you are talking to a trusted source.

Password Security

At White Rose Credit Union, we want to help you keep your personal information safe and secure. WRCU encourages all members to verify your contract information so you continue to receive account and credit card statements, other correspondence and protect your personal information from falling into the wrong hands.

Verify your information today:

- Mailing Address

- Phone Number – primary and/or cell phone

- Email Address

Verifying your account information is easy! Simply log into Online Banking and send us a Secure Message. Or, visit one of our convenient branch locations to complete a Change Of Information Form.

Unemployment Fraud

Unemployment fraud is on the rise, especially after the COVID-19 pandemic. If you believe you are a victim of this, please view the resources available to you by clicking here and call us at 717-755-9773 for any account-related assistance.

Identity Theft Resources and Victim Assistance

Remember, reputable organizations such as the National Credit Union Administration (NCUA), Credit Union National Association (CUNA), Cardholder Services and White Rose Credit Union will never contact you by phone or email to ask you personal or financial information.

If you receive a suspicious email, phone call or letter, please do not respond to it and contact the local authorities. If an item appears to come from WRCU, contact our office at (717) 755-9773 to verify the validity of the inquiry.

Credit Card and Debit Card Users: WRCU partners with a third-party vendor to monitor suspicious and fraudulent activity on your debit or credit card. You may receive a call from Falcon/Cardholder Services attempting to verify the activity on your account. Please note the representative will not ask for your personal information. This is a valid call to contact you regarding the suspicious account activity. Please contact us directly should you have any questions about the call you received.

Five Steps to Reclaiming Your Identity

Step 1: If you suspect suspicious activity, place a fraud alert on your file with all three credit bureaus.

- Experian | (888) 397-3742

- Equifax | (800) 525-6285

- TransUnion | (800) 680-7289

Step 2: Close all accounts that were affected. It may help to write down all the facts regarding the situation in an I.D. Theft Affidavit and file it with all affected creditors.

Step 3: File a police report and keep a copy.

Step 4: File a complaint with the FTC*.

Step 5: Alert your credit union and all your unaffected creditors. A fraudulent charge may have been reported to them, causing a change in your rates.

*To file a complaint with the FTC, or to learn more about recovering your identity, visit the FTC’s Identity Theft website or call (877) 438-4338.

For more information concerning identity theft please click here.

Sharing Personal Information

Companies, marketers and government agencies may use your information simply to process orders you place; they may also use it to tell you about products, services, or promotions, or they may share your information with others. More organizations are offering people choices about how their personal information is used. For example, many let you “opt-out” of having your information shared with others or used for promotional purposes.

The three major credit bureaus—Trans Union, Experian and Equifax—may have different requirements on how to opt-out, and offer a toll-free number that enables consumers to opt-out of all pre-approved credit offers with just one phone by dialing (888) 5-OPTOUT or (888) 567-8688.

If you receive a phone call in which you are asked your credit card or account numbers, social security number or any other personal or financial information, stop! Remember, a company you do business with should already have this information on file and should not need to ask you for it. To protect yourself, simply say, “This isn’t a good time. I will call back.” Then hang up the phone and contact the institution from which the caller said he or she was from to see if there is truly an issue with your account. Find the company’s phone number from the phone directory, a current statement or the company’s official website.

If you receive an email that contains an urgent message about an account, stop! Do not click on the link, delete the email immediately, and contact the institution from which the email appears to have come. Find the company’s phone number from the phone directory, a current statement or the company’s official website, not the number that may be listed in the suspicious email.

The Federal Trade Commission’s website has information on protecting yourself, what to do if you fall victim as well as a sample opt-out letter.

General Computer Security

- Keep your anti-virus software up to date. Anti-virus software needs frequent updates to guard against new viruses. Download the anti-virus updates as soon as you are notified that a download is available. Some antivirus programs offer an “auto-update” feature, where regular updates are made automatically for you.

- Maintain current versions of your computer’s operating system and Internet browsers.

- When you are not online, always disconnect from the Internet.

- Always back up the files on your computer.

- Install a personal firewall to help prevent unauthorized access to your home computer, especially if you connect to the Internet via a cable modem or a digital subscriber line (DSL) modem. Click here for more information regarding how not to get hooked by a phishing scam.

Reach out to one of our team members immediately if you believe you have been the victim of any type of fraud on your account or may be at risk.